What are the Exit Options for Owner-Manager Shareholders?

Shareholders across the Owner-Manager landscape will at some point be asking themselves this very question.

Whether you are a full or partial shareholder, the time will come when you will want to release your equity value and exit the business in some way. Identifying the best route to do this will be the first challenge you will face.

Despite the number of letters shareholders receive from companies offering to help with equity release, signing up to one route is not something that should be rushed into without comparing the full range of exit options against your personal aspirations: #Trade-exit #VC #PE #banks #MBO #MBI #refinance #etc.

Further, when you start to explore these options, you need to get to grips with the individual “buyer dynamics”. Each buyer has a very different set of drivers, where there is a right way and a wrong way to approach these dynamics, especially when seeking to maximise the value they will place on your shareholding and achieve your desired exit outcome.

In order to help with these considerations, I list below three key activities you should work on before you start the exit process:

Review the Exit Route Options

Hunt out the buyer acquisition rationale

Consider what will maximise the value of your business for each buyer.

1. Review the Exit Route Options

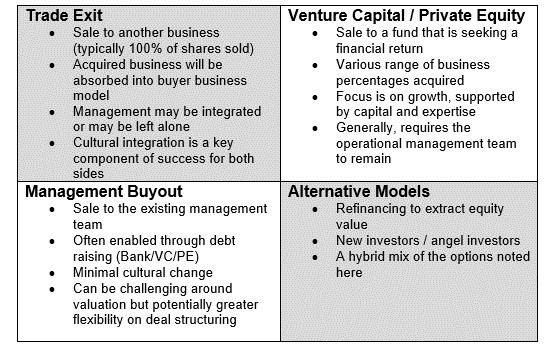

There are primarily 4 main exit routes available to shareholders of owner-managed businesses:

Each of these options result in quite different outcomes and so a primary question to ask yourself is:

What am I seeking to achieve from the sale of my shares?

The answers can be numerous: walk away from the business; retire; stay involved with no equity; stay involved with equity; start a new business venture; engage a financial backer for business growth; ski more.

2. Hunt out the Acquirer’s Buying Rationale

To maximise the value placed on your shares, regardless of which of the above options works for you, you MUST MUST MUST present your business in a way that will:

1. Engage strong appropriate buyer interest

2. Enable the buyer to see the value your business will bring to them

3. Attract buyers who are credible, appropriate and have funds to complete

In order to deliver on these objectives you will need research on the buyer pool and an understanding on what they place value on. Is it services, products, technology, sector expertise, past growth, forward growth potential, sustainability, geography, IP, leadership team, fragmented market dynamics for example? There will be others.

Only when you understand what the buyer values are you then able to highlight the aspects of your business that they will place worth on. Note that sometimes these value elements are not always obvious to a buyer and so you must help them see these gems!

The outcome of this means that when buyers see the worth of your business it is more likely they will pay you the price you deserve. If you are in a situation where you don’t have a defined strategy around the exit route and the buyer values, you risk losing a significant amount of value on exit.

3. Consider how to Maximise the Value of your Business.

In addition to “who” you present to you must consider “what” you present.

I list below a number of the more universal factors that buyers place value on, for you to consider when drawing up your marketing documentation (teasers, information memorandums, pitch decks):

- The potential of the business in its market / sector. Sounds obvious but don’t forget it.

- A coherent and credible story of where the business has come from and what it can achieve in the future. Buyers need to understand the journey of your business.

- A strong team that can lead further business growth. These are the people the buyer is betting on to deliver the forward plans.

- Robust financial data, including a summary and detailed back-up. This gives the buyer confidence that you are in control of the numbers and the latter enables a quicker due diligence process. (If you don’t have this, it can be created for you. See below on Partners)

- Risk mitigation planning, addressing the “what-if” scenarios that a buyer may choose to raise. This will head-off factors that may kill value, or worse kill the deal.

- Potential for credible growth beyond the current business model, into new sectors / geographies / technologies for example. This provides a vision of a bigger business potential.

- Good market awareness such as client, competitor and market awareness. This helps the buyer understand where you are positioned in the market.

This is a non-exhaustive list but I stress again, help the buyer see the gems that they will be getting when they purchase your business.

Keep your Eye on the Ball!

Make no mistake, selling your business is a large burden on the shareholders and potentially the business. One of the biggest value killers occurs when the business’ management focuses more on the exit process than the business itself, leading to disengagement with clients, staff and other market dynamics alike. These generally result in sales downturns, which no-one welcomes; especially a buyer!

As in any major project undertaking, make sure that the core business model has the right resource and rigour applied to it to ensure business sustainability and continual growth throughout the exit process.

Take the Right Partner

Finally, I have to stress that planning ahead, keeping your eyes open and not doing it alone are a combination of guidelines towards a successful exit and sale process. There are professional partners out there whose sole interest is to help you leverage the right outcome, get you to a “pitch-deck ready” state and support you throughout the whole journey. The good ones will feel like they could be an extension of your team in the first meeting. They should bring the experience and connections that ease the journey, maximise your potential return and improve the chance of a successful exit.

Some questions I would recommend you ask of these partners centre around

- Sector Experience – Do they know the buyer pool or have the tenacity and capability to develop it?

- Transaction Experience – Does the partner sat in-front of you know what they are doing? Have they done it before? Will they stay the course?

- Cultural fit – Will they be there when you need them?

Whilst the basic steps involved in selling a business are often seen as a standard process, the dynamics and factors involved along the way make it far from standard. Upfront awareness and adaptability along the way are key skills you must engage in the journey.

“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.” Jimmy Dean.

Rupert Lewis works at Premier Corporate Finance’s Manchester Office.

An experienced director with proven track record in supporting growing businesses, including start-up, SME, PE/VC and plc organisations, Rupert has extensive global M&A and fund raising experience and is actively supporting businesses seeking funding and exit advice.

Contact Rupert on: rupert@premiercf.co.uk